How Being Overweight Affects Life Insurance Rates

Let’s cut straight to the big question:

Can I get life insurance if I’m overweight?

Here’s the answer: It depends.

Some insurance companies might find your weight to be a big enough factor to consider not approving you for insurance. But, it’s not necessarily because of the weight per se, but rather, the potential health issues that can arise or be linked to it.

For example, it increases your chances of acquiring coronary heart diseases, as well as increased risk of stroke. Type 2 diabetes is also common among if you’re overweight..

So what does this mean? It means there’s a small chance you might not get approved because of the potential risks that go along with being overweight. In most cases, however, you’ll still get approved albeit at a higher premium rate.

Again, weight is not the sole indicator if you’ll be rejected. If you’re a bit on the heavy side, your potential insurer will likely have you go through a medical exam to get more information to reach a credible decision.

What are the consequences of being obese when you apply for life insurance?

If you do get approved for coverage even though you’re overweight, expect to pay more.

Health risks are increased significantly when a person is overweight or obese. The insurer will counteract this higher risk in providing you with coverage by setting a higher premium. The bottom line is that a healthier person will have a much better insurance rating versus someone who is overweight.

What if I’m morbidly obese? Can I still get life insurance?

Absolutely. To give you a better idea of how weight is factored in when applying for insurance, let me tell you about Body Mass Index (BMI) first.

What is BMI and how does it affect my Life Insurance?

Body Mass Index, or BMI, is a screening tool used to determine if a person is below, average, or overweight. Calculating BMI involves two things: weight and height.

Taking a person’s height, gender and age into consideration, a corresponding average weight is linked to it. If you go beyond this average, then that’s when you will be tagged as either under or overweight.

Insurance companies measure a potential policyholder’s BMI to determine associated health risks. For example, a person who is underweight may expose signs of malnutrition, osteoporosis, or anemia.

On the other hand, an overweight person is more likely to develop high blood pressure, diabetes, and other heart-related issues normally associated with excessive weight.

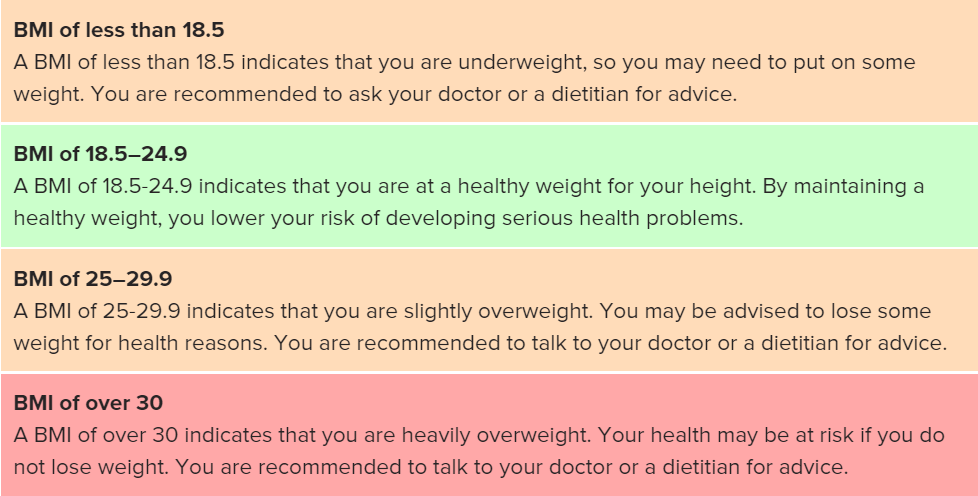

When the insurance underwriter reviews an application, one of the first things they check is the person’s BMI.

They use the scale above to determine if a potential policyholder is exposed to higher risk due to their weight. If they are, they will likely quote a higher premium, though this is not always the case.

The bottom line is that obesity and BMI scores tend to be a proxy for whether a candidate is considered in good health.

Does being obese automatically translates to being unhealthy?

Several studies have been made to prove a link between BMI scores and good health. And the results are surprising.

According to The Journal of Obesity’s case study performed in 2016, data shows that tens of millions of Americans that are overweight and obese are actually healthy.

Here’s what’s even more interesting: The same research concluded that 30% of the participants considered to be within the normal BMI range are actually NOT healthy based on their other medical data.

What does this mean? From a scientific standpoint, it proves that being tagged as overweight or obese using the BMI scale does not necessarily mean the person is unhealthy. There are other factors to be considered when trying to determine if someone is actually in good health.

This result echoes that of another study conducted by the European Heart Journal in 2012. The research revealed that there are people who are considered obese but are metabolically healthy. That is they don’t have high BP, diabetes, and other health markers that are considered risky.

This result echoes that of another study conducted by the European Heart Journal in 2012. The research revealed that there are people who are considered obese but are metabolically healthy. That is they don’t have high BP, diabetes, and other health markers that are considered risky.

Put simply, there are people out there who may look fat but are actually metabolically fit.

From an insurer’s standpoint, however, an overweight person has a higher risk of contracting diseases, thus the higher premium. Do note, however, that insurance providers do not follow one standard guideline when it comes to BMI. Each company will have their own set of testing procedures to make a full decision on the type of life insurance policy you can get.

What factors are considered when it comes to weight in relation to life insurance?

There are 5 main factors that underwriters look into when assessing your weight with regards to the policy you can get:

Weight gain or loss in the last 12 months

You can’t trick underwriters into giving you a better rating by simply going on a crash diet. They will look at your weight for the last 12 months and determine if the weight loss is significant and not merely done to get better rates.

You must be able to show that the weight loss has been sustained for more than a year otherwise they will only credit you for half of the lbs you lost. More on this later.

Your current weight and height

Your body type plays a huge role in accurately assessing if you’re healthy or not. For example, your BMI might tip on the high side of the scale in relation to your height.

However, if other tests prove that you have low body fat percentage, underwriters might consider this a plus and actually help you improve your scores.

Your last visit to the doctor

Medical records give insurers a bird’s eye view of your health history and help them reach a credible decision on the type of policy you can get. Without it, it may negatively affect your score simply because the insurer might deem your case riskier since they don’t have medical records to refer to prove that you’re healthy.

Issues with mobility brought by being obese or overweight

If during underwriting the insurer finds out that you’re having problems moving around due to your weight, expect that to have a negative impact on your final score. Why? It might raise questions that the insurer can link to other possible health issues.

If they find out that you move outside your house using a power wheelchair, for example, and you tell them that it’s because you tire fast and lose your breath quickly, it’s a red flag that can be linked to potential hypertension or diabetes.

Smoking

While smoking is already a negative health marker in itself, it will further negatively affect your overall rating when combined with obesity.

Will shedding off some weight before applying for life insurance help?

It should, but only up to a certain point. See, underwriters will only credit you for half of the weight you lost. The reason? They want to make sure that the weight loss is permanent.

For example, let’s say you tried to apply for life insurance today and you were given a “Standard” rating because you were tagged as obese based on the BMI scale. You then decide to lose the excess pounds and re-apply later when you’ve hit the ideal BMI.

After 6 months, you lost 30 pounds, putting you in the ideal BMI limit for your height and age group. You found out later that the insurance company will only credit half of what you lost, which is 15 lbs. Why?

Insurance companies will likely give you a better rating (“Standard” to “Preferred Plus” for example) if you were able to sustain the weight loss for at least 12 months. Since the 30 pound-loss happened in 6 months,, they will only credit you for half of it.

Since they will be asking you for your weight for the previous year, there’s no getting around it. And if you think surgery is the answer, think again.

It will most likely give you a worse rating simply because you’ve undergone a medical procedure. And, from an insurer’s standpoint, that’s not good.

But what if you lose weight a few years after purchasing a policy?

First, check with your life insurance company if they will allow you to negotiate for better rates due to improved health and BMI scores. Some will consider while some may not.

If you’re able to show proof via medical records that you’ve consistently maintained ideal weight in the last few years, they might consider your request for a re-assessment.

If they tell you, however, that re-assessment for better rates is not allowed, you can always shop around with other providers and see if canceling your current one will prove to be more cost-effective.

Rules and policies notwithstanding though, losing weight and maintaining it is always a good idea not merely because of potential cheaper life insurance rates but in keeping a healthy body overall.

Life Insurance Tips for Overweight and Obese Applicants

All the stuff we mentioned above can be summarized into this:

Being obese and overweight can negatively impact the type of life insurance policy you can get.

The good news is that there’s still a high chance for you to qualify for a life insurance. And, to help tip the scales into your favor, try to apply the following tips as early as now.

Visit your doctor regularly

Let’s make it clear: Getting regular checkups is highly recommended whether you’re applying for life insurance or not. But for our purposes, what exactly does this help with?

One, it helps you build a solid medical history that your life insurance company will refer to for determining your health status and coming up with an appropriate policy.

Two, by seeking medical advice on a regular basis, you’re keeping yourself informed of what’s happening to your body and get immediate feedback and advice on what you should do. The result? Better chances of sticking to your ideal weight which is helped by receiving solid advice from a medical professional.

Start losing weight now

Why wait? Losing weight and getting a healthy body brings improvement to almost ALL areas of your life. If you start now, your body will be in a better position to get better ratings when you apply for life insurance.

Remember our advice earlier regarding the 12-month minimum for weight loss? By getting yourself fit and healthy now, you’ll have the necessary headstart and prove to the insurer that you’ve been able to sustain the ideal weight for more than a year (which will help you get better scores).

Prepare for the medical exam

It’s ideal to take the medical exam first thing in the morning and in a fasted state. Why? Because it helps you get a more accurate result and avoids fluctuations in your blood sugar levels brought about by eating.

Make sure to get enough sleep and don’t tire yourself the night before. This will help ensure your body is in tip-top condition for the exam.

Shop around

As with any financial commitments, due diligence is key. Remember, you could be spending a significant portion of money for life insurance. So it pays to do your homework and look around for the best deals for your situation.

Not all life insurance companies are created equal. You owe it to yourself to get the best deal for your money with a company that has a proven track record.

Work with a professional

But what if you can’t do it yourself, you ask? There are literally dozens of life insurance companies out there. How will you know which one is the best? Which one offers the best life insurance rates? Which ones are the most flexible? Most proven?

In this situation, it might be best to get credible advice from a professional. They can advise you on what to look for, which ones to check, what to do, and which provider offers the best policy for your case.

Instead of trying to figure all of this out by yourself and get confused, seek help from someone willing to guide you to the best life insurance policy for you and your family’s needs.