Life Insurance With An Atrioventricular Block

When you are diagnosed with a health condition, especially one related to the heart, it can cause you to panic if you’re trying to find life insurance with an atrioventricular block. Finding the right life insurance policy, going through the application process, and getting approved can seem overwhelming.

Let us calm your fears and help you find the best rate for life insurance possible for you! We have knowledgeable agents that can help steer you towards the best companies that will have the greatest chance of getting you approved, even if you aren’t in the best of health.

If you’ve been diagnosed with an atrioventricular (AV) block, and you are worried that you might not qualify for life insurance, you are in the right place. We are here to tell you that you CAN get approved and walk you through how to get final approval.

Keep reading to find out more about how you can get approved for life insurance with an atrioventricular block. Then, we’ll dive into what information you will need for the application process, what to expect, and tips on getting the best rate.

What is an Atrioventricular Block?

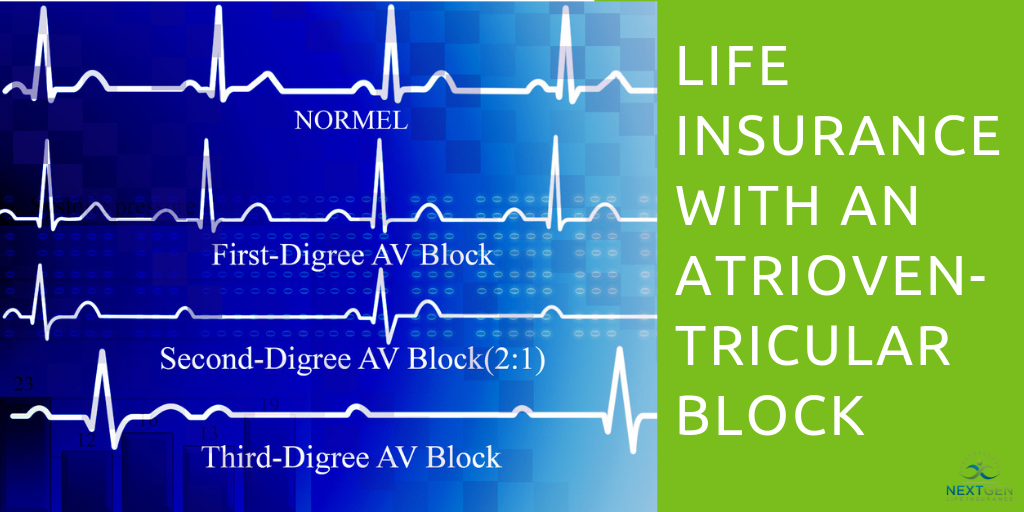

Having an AV block means that the heart is pumping arrhythmically, delaying or completely blocking the impulses sent from the aorta to the ventricles. The block is classified based on severity, with first degree being the least concerning and third degree being the most.

Here is a brief description of each degree:

- First degree – heartbeats are not skipped but conduction is slowed. It is rarely symptomatic and there is usually no treatment needed

- Second degree – there are two types, labeled as Mobitz type I and Mobitz type II

- Type I – the PR interval lengthens with each beat, the impulse is incomplete, and the QRS complex is dropped due to narrowing. This creates a reliable atypical rhythm. Treatment is limited to symptomatic bradycardia and resolved by installing a pacemaker.

- Type II – the PR beat interval stays constant but beats are intermittent and QRS complexes are dropped. This usually creates a pattern on each 3rd or 4th wave. Patients are at higher risk for having complete AV block, so a pacemaker is installed and it could require a permanent pacer.

- Third degree – The atria and ventricles do not communicate and there is a dissociation between PR waves and QRS complexes. Patients will have a permanent pacemaker and depending on cause and time of diagnosis, could be installed as an infant.

Causes

Now that we know the degrees of AV blocks and what they mean, let’s see what the causes are:

- Idiopathic progressive cardiac conduction disease – most common, up to 50% of patients

- Ischemic heart disease – second most common, up to 40% of patients

- Cardiomyopathy

- Myocarditis

- Congenital heart disease

- Familial diseases

- Certain medications

- Increased vagal tone

- Valvulopathy

- Prior cardiac surgeries

- Catheter ablation for arrhythmias

Completing the Life Insurance Application Process

Once you’ve received your free life insurance quote and are ready to move forward, the next step to completing the application process is getting your information ready. You want to be prepared when speaking with your agent to fill out the application, and with an atrioventricular block, you will need to provide more details.

When it comes to life insurance with an atrioventricular block, the degree that you have and the underlying cause are going to be the deciding factors. These factors along with your overall health will determine your life insurance rating on your policy.

Life insurance underwriters base policy ratings on mortality risk, and the more likely you are to die from a health issue, the greater chance you have of being denied. When it comes to heart problems like atrioventricular blocks, they will look closely at your health past to determine your mortality risk and assign you a rating based on that risk.

Factors that underwriters will look at when reviewing your case:

- Family health history

- Age at diagnosis

- Any other health conditions you have

- Your current health

- Any tests and their results from the last 5-10 years

- Treatments prescribed

Questions that you will be asked as part of the application process:

- What is your doctor’s name, address, and phone number – This includes your primary care doctor, cardiologist, and any other doctor you see regularly for health issues

- When was your last visit? What was the outcome?

- When were you diagnosed with an AV block?

- What was the cause?

- What treatment were you prescribed?

- If you have a pacemaker, how old were you when it was installed?

- What are the results of your last echocardiogram?

- Are you taking any medications?

- If so, what for? Is it due to your AV block or another health issue?

What’s the best rate I can expect to get?

There are three main ratings underwriters use when determining an applicants approval for life insurance with an atrioventricular block:

- Preferred – this rate is reserved for people in optimal health; no health concerns, height and weight are within guidelines

- Standard – this is the most common rating people are approved with; there may be some health issues but they are no risk to shorten life expectancy and are typical of the mass population

- Substandard – also called table rating, this rate is reserved for people who don’t qualify for standard due to health issues

To get approved for life insurance with an atrioventricular block, your rating really depends on what the underlying cause is and the degree of your block.

A first degree with no other health issues can still get approved with a preferred rating. A preferred rating will provide the best pricing over the life of the policy.

A second degree atrioventricular block will likely get you a standard rating at best. However, expect a substandard rating if you have other health issues, especially heart-related.

If you have a third degree block, expect a substandard rating at best. A third degree block caused by medication could potentially get you a standard rating if you are otherwise healthy.

Tips for getting the best rates for life insurance with an atrioventricular block

Here are some tips that can help you get the best rate on your life insurance policy.

Healthy Lifestyle

The best tip we can offer is to live a healthy lifestyle. Eat right, exercise regularly, and keep an eye on your blood pressure and cholesterol levels. The very first thing that underwriters look at when determining your life insurance rating is your height and weight. If those are not within the guidelines, you won’t get the best rating regardless of your other health concerns.

Audit Your Health

Check to see when your last echocardiogram and chest x-ray was completed. If it has been more than three years, you will want to schedule and have the test completed prior to completing your life insurance application. However, if the tests are older than three years, you risk being denied.

If your doctor has not done a treadmill stress test on you, request one. The results of this test could help you get a better rating for life insurance with an atrioventricular block.

Audit your health. By saying this, we mean to take a discerning look at your current health and see if there is anything you need to improve. Maybe you need to shed a few pounds by increasing exercise and/or changing your diet. Or you found out your cholesterol might be a little high.

If there are things about your health that you want to improve, you might want to hold off on submitting your application. But only do this if you are truly going to make the changes needed. The longer you wait to apply, the more likely your premium could increase or you might not get the coverage you need.

Be Honest

Be honest when you are getting your quote and completing the application. If you are found to have not been honest on your application, that factor alone can cause you to be denied. Due to your atrioventricular block, your medical records will be requested to confirm the information you provided. They also request further information, so honesty is always the best policy.

We’ve discussed getting life insurance with a pacemaker and heart issues previously. If you haven’t read those articles be sure to check them out to prepare the best you can for the application process.

What happens if I get denied?

Sometimes, your health concerns are too risky for the insurance company to want to make an offer, so they will decline your application. If this happens to you, don’t panic! There are other options available to you if you’re still wanting life insurance with an atrioventricular block.

You can always apply to another insurance company. Each company sets their own guidelines and risk tolerances. Just because you were denied by one company does not mean you won’t get approved by another.

If you have other health issues, whether or not they are directly related to your atrioventricular block, you might not qualify for underwritten life insurance.

There are companies who will still approve you regardless of health. As long as you can fill out the application and haven’t been diagnosed with a terminal illness.

Guaranteed issue life insurance is more expensive because there is no rating structure. It is based on your age at the time of application and coverage amount you need. If you don’t have life insurance anywhere else and want at least a small policy so that your beneficiary has something they can use for funeral expenses, this might be an option worth considering.

If your health improves after you have been denied life insurance with an atrioventricular block, don’t be afraid to reapply. Having the knowledge and experience of going through the process once already can give you the confidence to go through it again.

Don’t forget, we are here to help you through the process and getting the best rate. Act now to get your free life insurance quote from one of our agents.