What Exactly is a Free Life Insurance Quote?

Getting a free life insurance quote is no different from getting a sample estimate for any other type of purchase. Whether it’s a buying a new car or house, hiring a professional, or shopping for a new gadget, getting a quote is important because it allows you to gauge an item or service’s worth in relation to its price.

As my wife always says, we always need to get three quotes before making a decision. And, the same goes for life insurance.

When it comes to life insurance, getting an estimate takes mere seconds to complete. On this life insurance quoter, for example, all you need to do is fill in the required information. Once entered, hit the “Display Quotes” button—voila! Your estimated life insurance policy premium will be displayed on the next screen. And, best of all, you’ll have multiple quotes from some of the biggest life insurance companies. Simple enough, right?

What are free life insurance quotes

These free life insurance quote services will vary from one insurance company or website to another. However, the goal is the same: To give you an idea of how much a life insurance policy will cost depending on his coverage needs and personal information (health, financials, activity).

Why get free life insurance quotes

It’s a hassle-free way of shopping around when making a comparison between insurers. Note that this is not the actual price yet and you’ll need to take the next step if you want to have an actual quote. However, it still gives you a quick way of estimating how much term life insurance will cost for your age and health, for example.

Where to get free life insurance quotes

You can get your free life insurance quote from any of these types of websites:

Official insurance company websites

If you have a particular insurance company in mind, you can simply visit their website and look for their life insurance section. Look for the page where it says, “Get your quote” or “Get an estimate” and follow the instructions from there.

Third-party websites that offer insurance services

Sites like this one provide life insurance estimates from several companies at zero cost. The best part about it is that it gives you a preview of all estimated policy prices from a selection of insurance companies on one page. This makes shopping for life insurance much easier and more convenient.

Types of free life insurance quotes

Personal information required

Most official insurance company websites will require you to enter some personal information in order to get a life insurance quote. They will use the data you provide to come up with a matching policy that suits your needs and health background.

While traditional insurance companies will give you the initial quote after providing some personal information, newer “Insuretech” companies like Ladder Life and Haven Life take it a step further by providing you with the option to get an actual term life insurance policy within minutes, if you’re not required to have a paramedic exam.

No Personal information required

If you simply want to get a rough estimate of how much a life insurance policy will cost, third-party websites will give you an idea on various price estimates from different insurance companies. Most will only require you to enter your age and health class, along with the desired face amount.

How are life insurance quotes calculated?

Before we answer this question, it’s best to know first what life insurance premiums are and explain how the general process of life insurance works.

Life insurance premiums are what you pay the insurance company in order to keep your policy in place. In exchange for these premiums, the company guarantees a lump-sum payment (also known as death benefit) to chosen beneficiaries upon your death.

There are 3 factors that affect how premiums are calculated:

- Mortality – The concept of life insurance is all about knowing the levels of risk associated with a certain group of people. Insurance companies are in the business of getting paid in exchange for the future chance of paying a death benefit for a policyholder.

In order to determine how much of a risk they are taking for a certain individual, they have to determine his or her life expectancy. In life insurance, “Mortality tables” are used by companies in order to get an estimate on how much they will need to pay for claims on an annual basis.

- Interest – Companies don’t simply put premiums they receive in banks. They invest it in a variety of ways: stocks, bonds, real estate, mortgages, options, etc. Each investment vehicle is analyzed and utilized based on the earnings from interest the funds will earn while they remain invested.

- Expense – Like other businesses, life insurance companies have their own operating expenses. Some examples of these expenses are employee salaries, technology, rent, postage, etc. A certain amount of these expenses are built into the premiums quoted by the insurance company. This amount will vary from one company to another depending on how these expenses are incorporated.

It’s difficult to pinpoint a standard monthly insurance cost simply because no person will have the same health, financial capacity, lifestyle, etc. That being said though, insurance companies are still able to at least narrow down to an estimated figure for a specific demographic.

Here are 7 factors that insurance companies consider when calculating a person’s life insurance policy cost:

- Coverage amount – Can be Whole or Term Life insurance. Death benefits for term life insurance range anywhere from $50,000 to millions of dollars. For whole life insurance, riders are taken into consideration as well, so it’s a bit more complicated to estimate versus term.

- Lifestyle – It boils down to the activities you engage in. If you’re into high-risk sports or adventure, you’re exposed to a higher risk which will potentially translate into a higher premium.

- Type of job – The type of occupation you have plays a role as well. If your job presents a certain level of hazard or risk, you’ll likely be quoted with a pricier premium

- Gender – A person’s gender is considered in relation to the other factors mentioned in this section. Also, women tend to live longer than men according to studies so this may play a role as well in determining risk.

- Health – Plays a vital role in determining a person’s mortality. Insurers will check a potential policyholder’s health history from the last 10 years to determine if he or she underwent any significant health-related operations or conditions.

- Age – Older people will be quoted with a higher premium simply because their life expectancy is shorter versus younger policyholders.

- Weight – An overweight or obese person will likely have to pay a more expensive premium because insurance companies view obesity as a potential sign/symptom that may lead to other health risks.

- What are the different types of life insurance rate classes?

You probably noticed from our screenshot earlier the term “Preferred Plus”. This is used to identify a person’s condition when it comes to their health. Here are the most common categories you’ll see when getting your estimate for life insurance.

Note: Ratings may vary from one insurer to another. Below are general descriptions used for each rating.

- Preferred Plus – This type of policyholder assumes no use of tobacco for at least the last 5 years. No serious health conditions, have healthy levels of cholesterol (ideally below 210) and have normal blood pressure (doesn’t exceed 135/85).

- Preferred – This type of policyholder assumes no use of tobacco for at least the last 3 years. Has above average health, cholesterol level is below 250, and has a normal blood pressure (doesn’t exceed 135/85).

- Select – This type of policyholder assumes no use of tobacco for at least the last 12 months. Has average health, cholesterol level is below 300, and has a normal blood pressure below 140/90.

- Standard Tobacco- This type of policyholder assumes tobacco use in the last 12 months. Has average health, cholesterol level is below 300, and has a normal blood pressure below 140/90.

How do I determine how much life insurance I need?

There is no recommended one-size-fits-all solution when it comes to life insurance. Each of us will have our own set of priorities that we want to cover with the death benefit. That being said, however, it’s a good idea, in general, to make sure you focus on your financial obligations when figuring out how much life insurance you need. Most experts recommend that you subtract your liquid assets from your projected total financial expenses (obligations) in the future to arrive with a rough estimate. For example:

Projected future financial expenses: Annual salary multiplied by X number of years you want to cover (income replacement) + debts + mortgage balance + needs for beneficiaries (funeral costs or college expenses, etc.)

This formula should help you come up with a rough figure for the death benefit which will help you determine how much coverage you’ll need.

If you can, try to get advice from a professional, especially if you’re not so confident with your own computation. They can assist you in that regard and provide you with a blueprint of how much insurance you need based on your current and future circumstances.

What is the average cost of life insurance in the US?

If you’re curious as to how much the average cost of life insurance is across the US, this table below will show you the prevailing averages for adults aged 25 to 50.

We’ll use the most popular option, 20 years coverage worth $250,000. (Non-smoker):

| Age | Monthly Premium | Annual Premium |

| 25 | $27.53 | $330.33 |

| 30 | $27.88 | $334.54 |

| 35 | $29.98 | $359.78 |

| 40 | $36.03 | $432.36 |

| 45 | $51.62 | $619.42 |

| 50 | $76.58 | $918.91 |

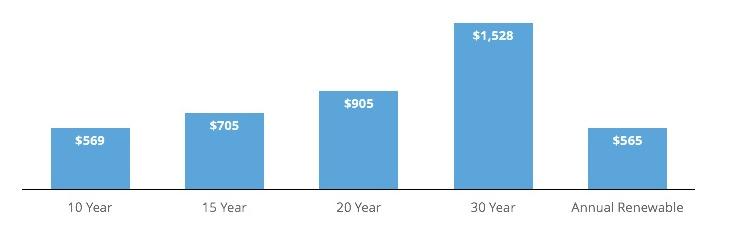

Value Penguin shared the below graph showing the average cost of life insurance in regards to the number of covered years. As you can see on the graph, premiums cost more for the longer duration of coverage, which is expected since a person’s risk (mortality/life expectancy) declines as they age.

Your health, financials, amount of coverage, and age (along with other factors mentioned above) all affect the final price of your life insurance premium. One insurance company might quote you with a lower (or higher price) versus another. And while you have no control over their final decision, you definitely can tip the scale into your favor through the following steps:

- Shop around – Compare prices. Use our life insurance quote feature to get an estimate. Each company will follow a different set of rules when it comes to pricing their premiums, so it’s worth looking around to zero-in on the best possible deal.

- Quit smoking – Did you know that the average premium a smoker pays can be as much as double of that of a non-smoker? That’s right. That’s how big of a deal smoking is when it comes to calculating your premiums. If you can, try to kick the habit not only to get a lower premium but to improve your overall health as well.

- A healthier lifestyle – Getting fit and losing the pounds will increase your chances of getting a better rate. The healthier a person is the better when it comes to insurance.

- Get the right coverage you need – In general, it’s not a good idea to over-insure. Why? Because unless you have the money for the higher premiums, you’ll be putting too much strain on your budget which can lead to you being unable to pay the premium.

- Don’t delay too long – The older you get, the more expensive the premiums become.

Conclusion

Getting life insurance is an important financial decision. It’s simply a must to do your due diligence when trying to figure out the details like the price of premiums, amount of coverage, duration, type of insurance, and more. However, don’t let these seemingly excessive details prevent you from signing up in the first place.

With enough research, you’ll realize that life insurance isn’t as complicated as most people think. And, if you feel you’re ready to sign up for a policy, make sure to check out multiple options and try our free life insurance quote feature so you can land on the best possible deal for your needs.